Zakat, one of the five pillars of Islam, is a mandatory act of charity that purifies wealth and fosters social welfare. Derived from the Arabic word meaning “purification” and “growth,” zakat is both a spiritual obligation and a practical mechanism to support the less fortunate, ensuring economic equity within the Muslim community. This comprehensive guide explores the types of zakat, their theological foundations, practical applications in daily life, and their significance in shaping Muslim character and society. Rooted in Quranic injunctions, Hadith, and scholarly interpretations, this exploration provides a detailed understanding of zakat’s role in Islam, with actionable insights for integrating it into daily practice.

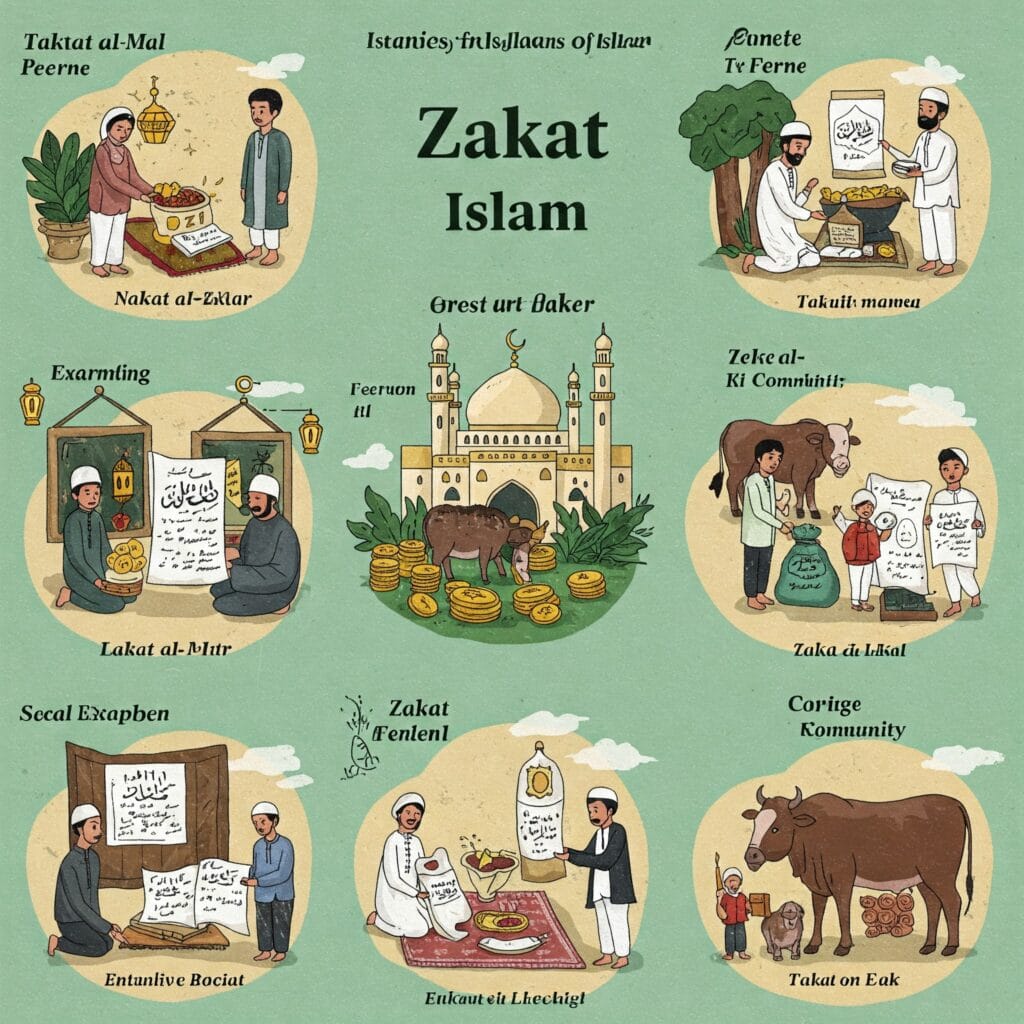

Introduction to Zakat in Islam

Zakat is an obligatory form of charity incumbent upon Muslims who meet specific wealth thresholds. It is distinct from voluntary charity (sadaqah) due to its fixed rates, conditions, and recipients. The Quran emphasizes zakat as a means of spiritual purification and social justice:

“Take, [O, Muhammad], from their wealth a charity by which you purify them and cause them increase, and invoke [Allah’s blessings] upon them.” (Quran, 9:103)

“And establish prayer and give zakat, and whatever good you put forward for yourselves—you will find it with Allah.” (Quran, 2:110)

Zakat is not merely a financial transaction but a spiritual act that strengthens faith (iman), fosters gratitude, and combats greed. In daily life, Muslims integrate zakat by assessing their wealth, calculating dues, and distributing them to eligible recipients, often annually or seasonally, depending on the type of zakat.

This guide categorizes zakat into its primary types—Zakat al-Mal (zakat on wealth) and Zakat al-Fitr (zakat of breaking the fast)—and explores their conditions, calculations, recipients, and practical implications in Muslim daily life.

Types of Zakat in Islam

1. Zakat al-Mal (Zakat on Wealth)

Zakat al-Mal is the most common form of zakat, levied on accumulated wealth that meets specific criteria. It applies to various assets, including money, gold, silver, livestock, agricultural produce, and trade goods, and is designed to redistribute wealth to support the needy.

Conditions for Zakat al-Mal

To be liable for Zakat al-Mal, a Muslim must meet the following conditions:

- Eligibility: The individual must be a free, sane, adult Muslim.

- Nisab Threshold: The wealth must reach or exceed the minimum threshold (nisab), equivalent to the value of 85 grams of gold or 595 grams of silver (approximately $7,000–$8,000 USD in 2025, depending on market prices).

- Hawl (Lunar Year): The wealth must be held for one full lunar year (354 days), except for agricultural produce and certain other assets.

- Ownership: The wealth must be fully owned and in excess of basic needs (e.g., food, shelter, clothing).

Quranic Basis: “And those who hoard gold and silver and spend it not in the way of Allah—give them tidings of a painful punishment.” (Quran, 9:34)

Types of Wealth Subject to Zakat al-Mal

Zakat al-Mal applies to various asset classes, each with specific rates and conditions:

- Cash and Savings: Money in bank accounts, cash, or investments (e.g., stocks, bonds) is zakatable at 2.5% if it meets the nisab and hawl.

- Example: If you have $10,000 in savings for a year, zakat is $250 (2.5% of $10,000).

- Gold and Silver: Jewelry, bullion, or ornaments are zakatable at 2.5%. For gold, the nisab is 85 grams; for silver, it’s 595 grams.

- Example: If you own 100 grams of gold worth $7,500, zakat is $187.50.

- Livestock: Camels, cattle, sheep, and goats are zakatable based on specific quantities and rates outlined in Hadith (e.g., one sheep for every 40 sheep owned).

- Hadith Reference: “For every 40 sheep, one sheep is due as zakat.” (Sahih al-Bukhari, 1454)

- Agricultural Produce: Crops like wheat, barley, dates, and grapes are zakatable upon harvest, with rates of 5% (irrigated by natural water) or 10% (irrigated by effort). No hawl is required.

- Quranic Basis: “And give its due [zakat] on the day of its harvest.” (Quran, 6:141)

- Trade Goods: Inventory or merchandise for sale is zakatable at 2.5% based on its market value at the end of the hawl.

- Example: A shopkeeper with $20,000 in inventory pays $500 in zakat.

Calculation and Distribution

- Rate: Typically 2.5% of zakatable wealth, except for agricultural produce (5% or 10%).

- Timing: Paid annually after assessing wealth at the end of the hawl, often during Ramadan for spiritual reward.

- Recipients: The Quran specifies eight categories of recipients (Quran, 9:60):

- The poor (fuqara)

- The needy (masakin)

- Zakat administrators

- Those whose hearts are to be reconciled

- Freeing slaves

- Debtors

- In the cause of Allah

- Travelers in need

Practical Application in Daily Life:

- Wealth Assessment: Muslims track their savings, investments, and assets annually, using tools like zakat calculators (e.g., Islamic Relief’s online calculator) to determine liability.

- Distribution: Many give zakat to local mosques, charities like Islamic Relief, or directly to the poor. For example, a family might donate to a community food bank or support a struggling relative.

- Example: A professional with $50,000 in savings and 100 grams of gold calculates zakat at $1,250 (2.5% of savings) plus $187.50 (gold), totaling $1,437.50, which they donate to a refugee aid program.

Scholarly Insight: Imam Al-Ghazali emphasizes that zakat purifies wealth by removing attachment to material possessions, fostering gratitude and reliance on Allah.

2. Zakat al-Fitr (Zakat of Breaking the Fast)

Zakat al-Fitr, also known as Fitrana, is a mandatory charity paid at the end of Ramadan, before the Eid al-Fitr prayer. It ensures that every Muslim, regardless of wealth, can celebrate Eid with dignity and joy.

Conditions for Zakat al-Fitr

- Eligibility: Every Muslim—man, woman, child, rich, or poor—must pay Zakat al-Fitr if they have surplus food or wealth beyond their basic needs for Eid day.

- Timing: Paid during Ramadan, ideally before the Eid prayer, to allow recipients to benefit on the day of celebration.

- Amount: Equivalent to one saa’ (approximately 2.5–3 kilograms) of staple food (e.g., wheat, rice, dates) per person. In 2025, this is often converted to a monetary value, around $10–$15 per person in the U.S., depending on local food prices.

Hadith Reference: “The Messenger of Allah (peace be upon him) prescribed Zakat al-Fitr as a purification for the fasting person from idle talk and obscene speech, and to feed the poor.” (Sunan Abu Dawud, 1609)

Purpose and Recipients

- Purpose: Purifies the fast by atoning for minor shortcomings during Ramadan and ensures the poor can celebrate Eid.

- Recipients: Primarily the poor and needy, though it can be distributed to other zakat-eligible categories (Quran, 9:60).

Practical Application in Daily Life:

- Payment: Families calculate Zakat al-Fitr for each member, often paying through mosques or charities. For example, a family of five might donate $75 ($15 per person) to a local food drive.

- Community Impact: In Muslim communities, Zakat al-Fitr fosters solidarity, as wealthier families ensure poorer neighbors have food for Eid. Mosques may organize distributions, providing rice, flour, or cash to families in need.

- Example: A mother in Fort Lauderdale pays $60 for her family of four, donating to a local Islamic center that distributes food baskets to low-income households for Eid.

Cultural Significance: In many cultures, Zakat al-Fitr is a festive act, with families preparing food or funds together, reinforcing communal bonds and gratitude for Ramadan’s blessings.

Theological and Spiritual Significance of Zakat

Zakat is more than a financial obligation; it is a cornerstone of Islamic faith with profound spiritual and social implications:

- Purification of Wealth and Soul: Zakat cleanses wealth from greed and purifies the giver’s heart, as per Quran 9:103. It encourages detachment from materialism.

- Social Justice: By redistributing wealth, zakat reduces inequality, aligning with Islam’s emphasis on community welfare (ummah).

- Gratitude and Taqwa: Paying zakat fosters gratitude for Allah’s blessings and strengthens God-consciousness, as it acknowledges that wealth is a trust from Allah.

- Economic Stability: Zakat supports the needy, stimulates economic circulation, and reduces poverty, creating a balanced society.

Hadith Reference: “The similitude of those who spend their wealth in the way of Allah is like a grain that grows seven ears, in every ear a hundred grains.” (Sahih al-Bukhari, 1410)

Integrating Zakat into Muslim Daily Life

Zakat influences daily life by encouraging mindfulness, financial planning, and compassion. Here’s how Muslims incorporate zakat into their routines:

- Financial Planning:

- Muslims monitor their wealth to determine zakat eligibility, often setting aside 2.5% of savings annually. Apps like Zakatify or Islamic Relief’s calculators simplify this process.

- Example: A small business owner tracks inventory and profits yearly, allocating zakat to support a local orphanage.

- Ramadan Focus:

- Many pay Zakat al-Mal during Ramadan for increased spiritual reward, alongside Zakat al-Fitr. Families discuss zakat during iftar, reinforcing its importance.

- Example: A family in a mosque community pools Zakat al-Fitr to fund Eid celebrations for refugees.

- Community Engagement:

- Muslims volunteer with zakat-distributing organizations or identify needy recipients in their neighborhoods, fostering empathy.

- Example: A student organizes a zakat drive at her university, collecting funds for homeless shelters.

- Education and Awareness:

- Parents teach children about zakat by involving them in calculations or donations, instilling generosity early.

- Example: A father helps his child donate $10 from their allowance as Zakat al-Fitr, explaining its purpose.

- Ethical Wealth Management:

- Zakat encourages earning halal income, as only lawful wealth is zakatable. Muslims avoid interest (riba) or unethical investments.

- Example: A professional invests in halal stocks, ensuring their zakat is pure.

Practical Tip: Use a dedicated savings account for zakat, contributing small amounts monthly to ease the annual burden. Consult scholars for complex assets like cryptocurrencies or retirement funds.

Challenges and Solutions in Practicing Zakat

Challenge: Difficulty calculating zakat on modern assets (e.g., stocks, digital currencies).

Solution: Use online zakat calculators or consult scholars from organizations like Al-Azhar or AMJA for guidance. Websites like Zakat.org provide detailed resources.

Challenge: Identifying eligible recipients in non-Muslim countries.

Solution: Partner with reputable charities (e.g., Islamic Relief, Zakat Foundation) or local mosques to ensure zakat reaches the needy.

Challenge: Forgetting to pay Zakat al-Fitr before Eid prayer.

Solution: Set reminders during Ramadan’s last week and pay early via online platforms to ensure timely distribution.

Challenge: Limited financial literacy about zakat obligations.

Solution: Attend zakat workshops at Islamic centers or read books like The Zakat Handbook by the Zakat Foundation.

Cultural and Global Perspectives

Zakat practices vary across cultures, reflecting local needs and traditions:

- Middle East: Zakat is often centralized through government agencies or mosques, funding public services like healthcare or education.

- South Asia: Families distribute Zakat al-Fitr as food staples (e.g., rice, flour), emphasizing communal Eid celebrations.

- Western Countries: Muslims rely on charities and online platforms to pay zakat, supporting global causes like refugee aid.

- Africa: Zakat funds community projects, such as wells or schools, addressing systemic poverty.

Global Impact: According to a 2025 report, zakat contributions globally exceed $500 billion annually, significantly alleviating poverty and supporting humanitarian efforts.

Conclusion

Zakat, encompassing Zakat al-Mal and Zakat al-Fitr, is a transformative pillar of Islam that integrates seamlessly into Muslim daily life. By purifying wealth, fostering generosity, and supporting the needy, zakat strengthens both individual faith and communal bonds. Zakat al-Mal ensures economic equity through annual wealth redistribution, while Zakat al-Fitr unites the community in Ramadan’s joy. Through mindful financial planning, community engagement, and ethical living, Muslims embody zakat’s principles, reflecting Islam’s emphasis on compassion and justice.

Incorporating zakat into daily life requires knowledge, intention, and consistency. By leveraging modern tools, consulting scholars, and prioritizing the needy, Muslims can fulfill this obligation with ease and impact. May Allah accept our zakat, purify our wealth, and grant us the ability to uplift our communities. Ameen.

Further Resources:

- Books: The Zakat Handbook by the Zakat Foundation

- Websites: Zakat.org, IslamicReliefUSA.org

- Apps: Zakatify, Muslim Pro

- Scholars: Contact local imams or organizations like the Assembly of Muslim Jurists of America (AMJA)

Must read:

- 10 Best Halal Dining Spots to Explore in Fort Lauderdale, Florida

- A Detailed Guide to Permissible and Forbidden Foods in Islam

- The 99 Divine Names of Allah (Asma ul Husna): Significance and Spiritual Benefits

FAQs

What is the difference between u003cemu003eZakat al-Malu003c/emu003e and u003cemu003eZakat al-Fitru003c/emu003e?

u003cemu003eZakat al-Malu003c/emu003e is an annual 2.5% levy on wealth (e.g., savings, gold) above the u003cemu003enisabu003c/emu003e threshold, paid by eligible Muslims. u003cemu003eZakat al-Fitru003c/emu003e is a fixed amount (around $10–$15 per person in 2025) paid by every Muslim at the end of Ramadan to purify the fast and support the poor for Eid.

Who is obligated to pay u003cemu003eZakat al-Malu003c/emu003e?

Free, sane, adult Muslims with wealth above the u003cemu003enisabu003c/emu003e (e.g., $7,000–$8,000 USD in 2025) held for one lunar year (u003cemu003ehawlu003c/emu003e) must pay u003cemu003eZakat al-Malu003c/emu003e. Basic needs (e.g., housing, food) are exempt.

Is u003cemu003eZakat al-Fitru003c/emu003e mandatory for everyone?

Yes, every Muslim—rich, poor, adult, or child—must pay u003cemu003eZakat al-Fitru003c/emu003e if they have surplus food or wealth for Eid day. It’s typically $10–$15 per person, equivalent to 2.5–3 kg of staple food.

When should u003cemu003eZakat al-Malu003c/emu003e be paid?

u003cemu003eZakat al-Malu003c/emu003e is paid annually after wealth meets the u003cemu003enisabu003c/emu003e and u003cemu003ehawlu003c/emu003e requirements. Many choose Ramadan for added reward, but it can be paid anytime during the year.

Can u003cemu003eZakat al-Fitru003c/emu003e be paid in cash instead of food?

Yes, most scholars allow paying u003cemu003eZakat al-Fitru003c/emu003e in cash (e.g., $10–$15 in the U.S.) if it benefits recipients more, based on local food prices. Some prefer food to follow the Sunnah.

Post Comment